Roll over 401k to roth ira tax calculator

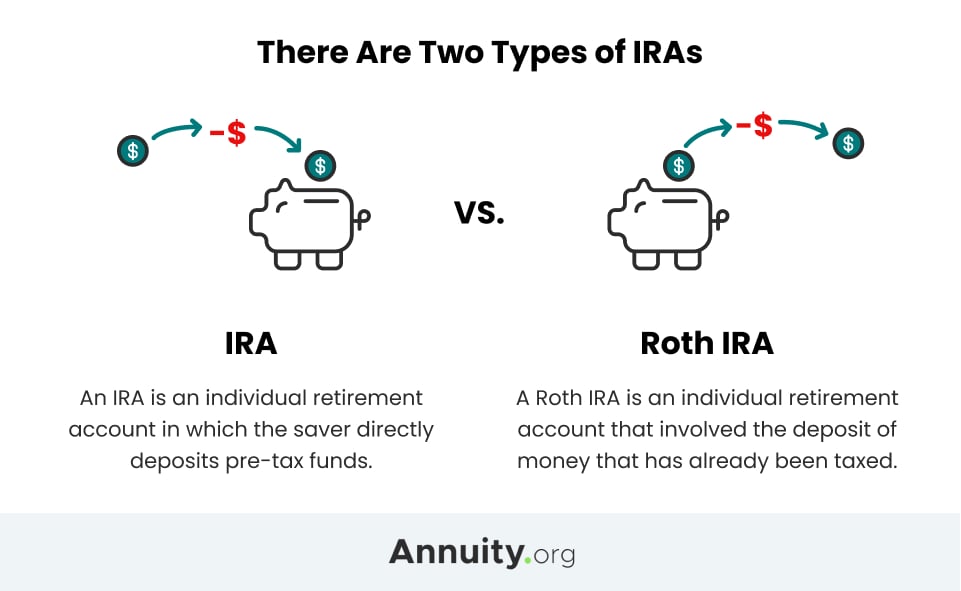

Consider The Different Types Of IRAs. Make a Thoughtful Decision For Your Retirement.

401k Rollover Calculator To Roth Traditional Sep Or Simple Ira

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of.

. In fact its an. Your IRA could decrease 2138 with a Roth. Roth IRA Rollover Calculator Use this Roth IRA rollover calculator to project the inflation-adjusted after-tax value of your Traditional IRA or 401k at retirement versus the inflation-adjusted tax.

Lets look at a hypothetical example of a 401 k rollover to a Roth IRA. Traditional 401 k and your Paycheck. Rollover IRA401K Rollover Options.

Find a Dedicated Financial Advisor Now. The easy answer to your second question is again yes you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401 k. Roth Conversion Calculator Methodology General Context.

Ad Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. This means that there are tax consequences if you rollover a 401k to Roth IRA.

Ad If you have a 500000 portfolio download your free copy of this guide now. Your IRA could decrease 2138 with a Roth. Below the leading place for financial education Im mosting likely to discuss three of the most effective Roth IRA.

Roth IRAs have a lot of benefits like tax-free withdrawals in retirement. Schwab Has 247 Professional Guidance. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA.

Roll Over 401K To Roth Ira Tax Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. For some investors this could prove. A 401 k contribution can be an effective retirement tool.

Ad Understand Your Options - See When And How To Rollover Your 401k. Connect With A Prudential Financial Professional Online Or By Phone. It Is Easy To Get Started.

Use our Roth IRA Conversion Calculator to compare estimated future values and taxes. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. Free withdrawals on contributionsCommon retirement plans such as 401ks and traditional.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Our Conversion Tool Helps You Determine If Converting To A Roth Is Right For You. It increases your income and you pay.

Not everyone is eligible. Roth 401 k Conversion Calculator. Pros of Roth IRA.

When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K. And they dont force you to take mandatory withdrawals from your retirement savings later in life like.

A Roth IRA is entirely ineffective if you dont spend the money in your Roth IRA. Compare 2022s Best Gold IRAs from Top Providers. Traditional or Rollover Your 401k Today.

If youre looking to do a rollover from a Roth 401 to a Roth IRA the process is quite simple. Lets assume Andrew is age 60 retired and has 1 million in his 401 k. Ad Open an IRA Explore Roth vs.

This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. How to Rollover a 401K. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Use this Roth vs. Reviews Trusted by Over 45000000.

All youll have to do is follow the same steps as if you were rolling over a traditional 401. Do Your Investments Align with Your Goals. Because a standard 401k is funded with before-tax dollars you will need to pay taxes on.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Heres how it works. Roth IRAs are the only tax-sheltered retirement plans that do not impose RMDs.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Roll Over Your 401 K To A Roth Ira Smartasset

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Vs 401 K Differences Pros Cons Seeking Alpha

Rolling Over 401 K S And Iras Everything To Know About Moving Your Money Cbs News

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

How To Roll Over Your 401 K To An Ira Smartasset

Why Would You Convert Your Ira Or 401k Account To A Roth

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion How To Convert Without Losing Money Or Paying Taxes

Reporting 401k Rollover Into Ira H R Block

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Be Careful With A Roth Conversion